Home Buying Tips

Home Buying Basics

A quick list of things you need to know before purchasing home

- Set up a free mortgage consultation with us to assess your borrowing needs and estimated closing costs.

- Obtain a pre-approval letter from us to let sellers know you have money backing the offer.

- Be prepared for at least a 3% down payment on your home (percentages vary for different loan products).

- Do not make any large purchases on your credit card or take out new loans. It could effect your debt-to-income ratio and disqualify you from buying a home.

Refinancing Basics

A quick list of things you need to know before refinancing your home

- Refinancing can help save you money and lower your monthly payment if you refinance to a lower interest rate.

- Look up your home price online. If your home price increased, you own more of your home which means you could get rid of mortgage insurance.

- Ask us about closing costs. When you refinance a portion of your closing costs can be wrapped into your loan to keep out of pocket costs low.

- Make sure you are current on your mortgage payments. If you are in forbearance or behind on your payments, you may not qualify.

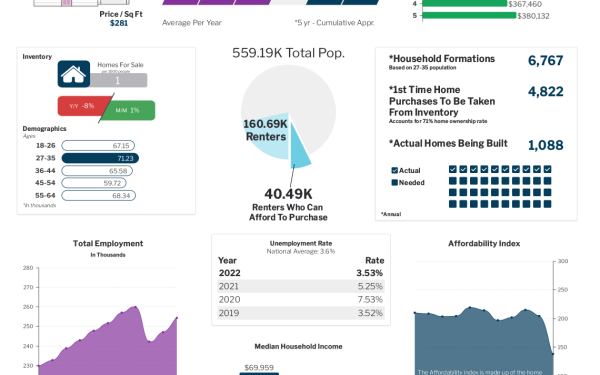

Want a real estate report card for the neighborhood you are looking at or currently living in? How about a buy vs rent calculator? Check it out over there ->

Home Buying Blog

Contact Us!

Like what you are reading? Fill out a quick form and pick the best time for us to call you!

Contact